Health Care Spending Account

Use the Claim for Health Care Spending Account Benefits form if you’ve paid for medical expenses that are eligible under the definition of a Qualifying Medical Expense under the Income Tax Act, which are not eligible for reimbursement under any other plan of benefits.

Information Needed to Complete the Form

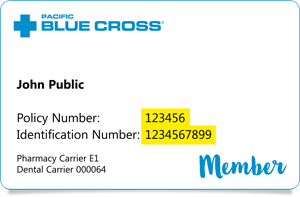

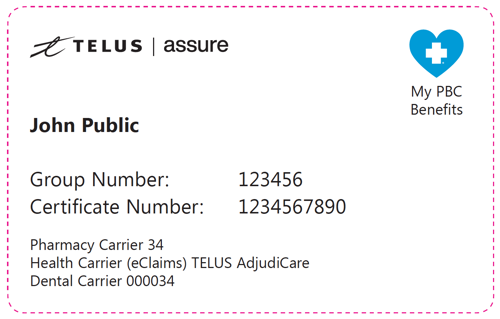

Your personal Member information and the Group policy number is needed to complete the form. In addition you must list the expenses to be reimbursed and include all original receipts.

Notes

The expenses must have been incurred by you or one of the eligible dependents currently on file with the Plan Administrator.

Completed forms should be forwarded to the Plan Administrator.

Frequently Asked Questions

What expenses can I be reimbursed for?

The HSCA benefit may be used to reimburse for such items as:

- deductibles and coinsurance of traditional plan benefits

- elective surgeries

- orthodontia, dentures and dental procedures

- laser eye surgery

- MRI, CT scans and cardiographs

- services from medical practitioners or hospitals

- eye glasses

- products required because of incontinence

- bone marrow or organ transplants

- drugs or medicaments that are prescribed by a medical practitioner or dentist and recorded by a pharmacist, used in the diagnosis, treatment or prevention of a disease or disorder; or

- in vitro fertilization procedures.

For a complete list of eligible expenses, see the Canada Revenue Agency web site.

Premiums paid to a private health services plan, such as for emergency travel insurance, may be reimbursed through the HCSA. Medical Services Plan of BC (MSP) premiums are not eligible.

Other questions on completing the form should be directed to the Plan Administrator.