Dental

Use the Dental Claim (English / French) form if you’ve paid your dentist the full cost of the services that are covered under your Plan and you wish to be reimbursed. Many dentists will bill your Plan directly for the portion payable under the Plan using their own Standard Dental Claim Form.

Information Needed to Complete the Form

Your dentist must complete Part 1 of the form. You complete Part 2 and Part 3.

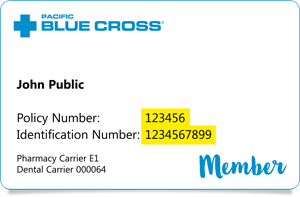

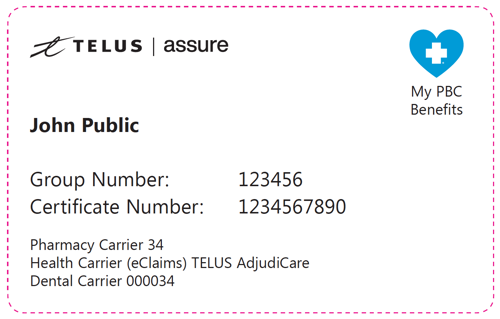

Part 2 is where your Member information is filled in, including your policy number. (If your dentist uses a Standard Dental Claim Form, your policy number must be included).

Part 3 is for patient information whether that is yourself, your spouse, or one of your dependant children. Part 3 also collects information about other Benefit or Insurance Plans that you may be eligible to co-ordinate a claim from.

Notes

The expenses must have been incurred by you or one of the eligible dependents currently on file with the Plan Administrator.

If you are unsure of your coverage, please contact your Plan Administrator in advance of the treatment to ensure your Plan will cover the expense. Costs not covered by your Plan must be paid by you.

Completed forms should be forwarded to the Plan Administrator. In order to protect patients’ personal information we request that you do not forward forms via email. Please contact the Plan Administrator who will provide you with a link to a secure file-transfer service that you will use to submit completed claims forms.

Frequently Asked Questions

What expenses can I be reimbursed for?

Eligible expenses are listed in the Health Benefit Plan Booklet that you received when you initially enrolled in your Plan.

My spouse also has dental coverage through work, how do I coordinate my claim with my spouse’s benefits plan?

If a Member or any eligible Dependents are entitled to receive similar benefits simultaneously under your Health Benefit Plan or any other group insurance plan (including Provincial Plans), to prevent over payment, benefits payable under this Plan would be co-ordinated with the other Plan.For example: A Member’s wife is covered under her employer’s plan with family coverage. The Member, his spouse and their three children are all covered under both Plans. To determine which plan would be primarily responsible for the dependent children: Between the Member and the spouse, whomever’s birthday falls first in the calendar year, their plan is responsible for the initial reimbursement of benefits for the dependent children, then, any amounts that are not paid by that Plan are submitted to the other parent’s plan.In the event that the Member’s birthday is in April and the spouse’s birthday is in January. The spouse’s plan would be primarily responsible for the spouse’s claims and the claims of the children. Any amounts not paid by the spouse’s plan can be submitted to the Member’s Plan for reimbursement. Any amounts for the Member that are not paid by the Member’s Plan can be submitted to the spouse’s plan for reimbursement.

Other questions on completing the form should be directed to the Plan Administrator.